If you withdraw money for anything that doesn’t meet the qualified expense criteria, any part of the distribution that is made up of earnings on contributions will be taxed as ordinary income and could incur a 10% federal penalty. If you're not sure whether a plan covers a particular college expense, the college's financial aid office should be able to help.Ĭheck with the school to find out exactly what's required so you can avoid accidentally taking a nonqualified distribution. These and other lifestyle expenses, like insurance, sports expenses, health club dues, and travel and transportation costs, will have to be funded through other resources. Be careful to avoid expenses that don't qualify-for example, equipment used primarily for amusement or entertainment doesn’t qualify. It's important to keep receipts and make sure that qualified items are purchased separately from nonqualified items.

List of 529 eligible expenses software#

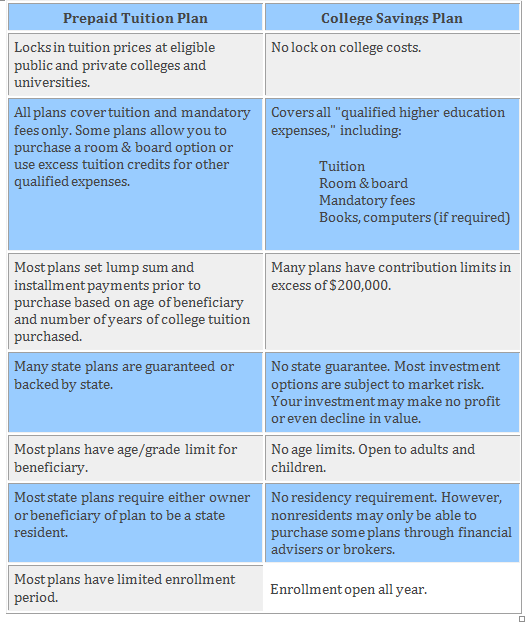

Computer software for sports, games, or hobbies would be excluded unless the software is predominantly educational in nature. Textbooks count as an education expense, but only those included on the required reading for the course.Ĭomputers and related equipment and services are considered qualified expenses if they are used primarily by the beneficiary during any of the years that the beneficiary is enrolled at an eligible educational institution. Also, keep in mind that in order for room and board to qualify, your child must be enrolled half time or more. So it's important to confirm room and board costs with the school's financial aid office in advance so you know what to expect. In other words, if your child is planning to live off campus in housing not owned or operated by the college, you can't claim expenses in excess of the school's estimates for room and board for attendance there. The actual amount charged if the student is living in housing operated by the educational institution.The allowance for room and board included in the school’s cost of attendance for federal financial aid calculations.Tuition and fees are considered required expenses and are allowed, but when it comes to room and board, the costs can't exceed the greater of the following 2 amounts: While funds from a 529 account can be used to pay for expenses required for college, not all expenses qualify. Eligible schools include any college, university, vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the US Department of Education. Money saved in a 529 plan can also be used to pay qualified expenses associated with college or other postsecondary training institutions. Although the money may come from multiple 529 accounts, only $10,000 total can be spent each year per beneficiary on elementary, middle, or high school tuition. As of 2019, qualified expenses include tuition expenses for elementary, middle, and high schools (private, public, or religious). When you pay qualified education expenses from a 529 account, your withdrawals are tax- and penalty-free.

Here's a 9-step guide to help you make your 529 savings go as far as possible.

List of 529 eligible expenses trial#

But learning by trial and error can be costly at tax time, and more importantly, your child could lose out on financial aid if you're not careful. What can you use this money for? Which expenses trigger taxes and penalties? If you do things right, no penalties or federal income tax-and, in many states, no state income tax-will be due on your withdrawals. However, with "accelerated gifting," * a 529 account can be funded with contributions of $85,000 per person or $170,000 per couple-which uses up your federal gift-tax exclusion for 5 years. Contributing more than $17,000 per beneficiary would need to be reported to the IRS as a gift. Grandparents can also contribute up to $34,000 per beneficiary per year. You’ll be in control of how much is withdrawn and how it'll be used, but there are a few things you need to know up front to make the most of your savings.įirst a reminder-you can save up to $17,000 per parent in a 529 account, or $34,000 per couple.

Now college is closer and it's time to think about spending the money you've put aside. Year after year, you and your child have been saving for college through a 529 savings account.

0 kommentar(er)

0 kommentar(er)